Should you trust investment advice from social media influencers? - A survey

A landmark survey of individual investors across the United Arab Emirates (UAE) by Friends Provident International (FPI) has highlighted the need for much greater regulation of financial advice provided by ‘celebrity’ social media influencer.

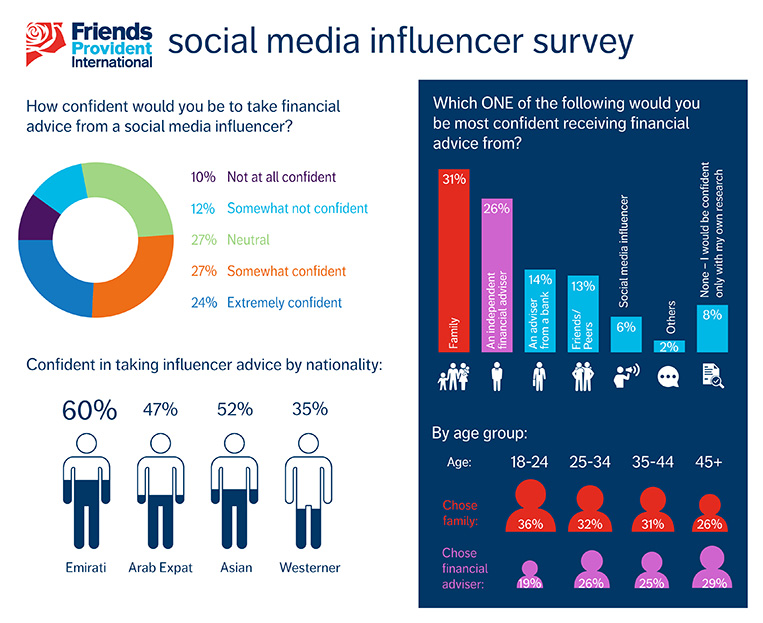

No fewer than 24% of individual investors said that they would be ‘extremely confident’ in taking financial advice from a social media influencer. An additional 27% said they would be ‘somewhat confident’ in doing so.

The YouGov survey was conducted on FPI’s behalf during December 2022. There were 1,005 respondents, who were classified according to: nationality; Emirate of residence; age; gender; and monthly income

Results varied markedly by nationality. At one extreme, 60% of Emirati investors said they would be ‘extremely’ or ‘somewhat’ confident in taking financial advice from a social media influencer. At the other extreme, the corresponding figure is just 35% for Westerners. Some 46% of Westerners said that they would be ‘somewhat not confident’ or ‘not at all confident’ in taking financial advice from a social media influencer

However, later in the survey investors were also asked to name which one provider of advice would make them feel better equipped to make decisions about their financial futures and social media influencers were named by just 6%. Of increasing importance were friends/peers (13%), bank advisers (14%), independent financial advisers (26%) and family (31%). Some 8% of investors said they relied entirely on their own research efforts, while 2% depended on other sources of advice in relation to their financial futures.

The extent to which investors said they relied on family members for advice about their financial futures varied widely. Women (39%) were much more likely than men (27%) to use a family member as a sole source of advice. The same was true of those who were aged 18-24 (36%) than those who are 45 or older (26%). Investors with monthly incomes of AED10,000 or less (37%) said they depended on family members more than those with monthly incomes of over AED25,000 (22%).

FPI Chief Executive David Kneeshaw said: “Individual investors in the UAE often place far too much weight on the views of social media influencers - who may be completely ignorant or paid to promote a particular idea or product.”

And he added: “A concerted publicity campaign that highlights the benefits of professional advice is not all that is needed. As is the case in other countries in which FPI operates, there should be far greater regulation in the UAE that curbs the impact of social media influencers.”